Before filing a collision claim, review your insurance policy to understand coverage for vehicle damage. Organize relevant documents and prepare detailed notes of incident specifics. Maintain open and honest communication with insurers, providing necessary details and photos for efficient claim handling.

Seamlessly navigate the collision claim process with our comprehensive guide. Before filing, understand your policy coverage to ensure a smooth experience. Gather all necessary documents to expedite the claims procedure. Effective communication with your insurance provider is key; be clear and provide detailed information. Avoid confusion and delays by following these steps for a successful collision claim.

- Understand Your Policy Coverage Before Filing

- Gather Necessary Documents for Seamless Process

- Communicate Effectively With Insurance Provider

Understand Your Policy Coverage Before Filing

Before initiating the collision claim process, it’s crucial to have a clear understanding of your insurance policy coverage. Every policy varies, offering different levels of protection for various types of vehicle damage, from minor fender benders to major accidents. Take time to review your policy documents, focusing on sections related to collision coverage. This knowledge will empower you to accurately assess the extent of the damage and choose the right repair facilities.

By understanding your policy, you can ensure that any repairs or replacement of parts are in line with what’s covered. For instance, if your policy includes comprehensive coverage for tire services, an automotive body shop might be able to accommodate such needs without incurring additional costs. This pre-knowledge will simplify the claim process and help streamline the interaction with your insurance provider, as well as the chosen collision repair center.

Gather Necessary Documents for Seamless Process

When preparing for a collision claim process, having all your documents in order is key to achieving a seamless experience. Begin by collecting important papers related to both your vehicle and the incident. This includes your vehicle registration and insurance policy, which are essential for any claim. Additionally, gather evidence such as photographs documenting the damage to your car—whether it’s a minor scratch or a significant dent—as well as any medical records if injuries were sustained during the collision.

The documentation process extends beyond just gathering papers; it involves preparing detailed notes about the incident. Record information like the date, time, and location of the collision, along with contact details of other parties involved. This comprehensive preparation facilitates a smoother car body restoration or vehicle dent repair process and ensures your claim is handled efficiently.

Communicate Effectively With Insurance Provider

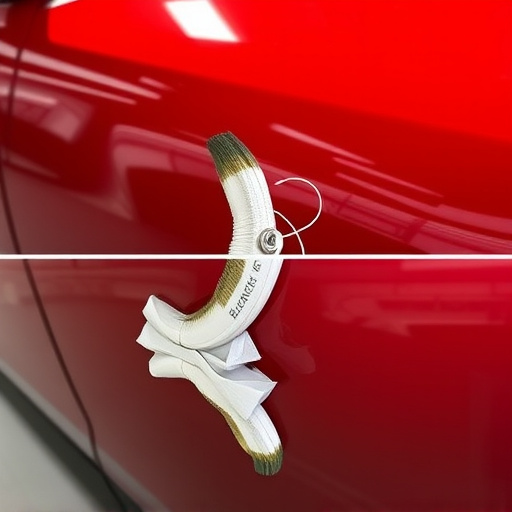

Effective communication is key to navigating the collision claim process smoothly. When dealing with an insurance provider, clarity and timeliness in your interactions can significantly impact the overall experience. Begin by gathering all necessary information related to the incident, such as details of the other driver involved, witness statements, and photos documenting the damage (including close-ups for any intricate vehicle features like a Mercedes Benz’s unique design). This preparation ensures you provide comprehensive data, aiding in a more efficient claim handling process, whether it’s for an automotive repair or simple dent removal.

When reaching out to your insurance company, be prepared to answer questions honestly and accurately. Explain the sequence of events leading up to the collision and any subsequent steps you’ve taken or plan to take, like arranging for a mercedes benz collision repair. Maintaining open lines of communication demonstrates your commitment to resolving the claim and can help prevent misunderstandings that might delay the process.

Applying for a collision claim doesn’t have to be a complex process. By understanding your policy coverage, gathering essential documents, and maintaining clear communication with your insurance provider, you can ensure a seamless experience throughout the collision claim process. Remember to stay organized, act promptly, and don’t hesitate to seek clarification when needed.