Understanding and reviewing your insurance policy's repair coverage is vital for protecting your vehicle post-damage. Insurance recommended repairs aim to restore your car to pre-incident condition, with some providers offering comprehensive parts and labor coverage while others may have restrictions or approved shops. Proper documentation, including detailed photos, communication records, and a list of suggested repairs, protects your rights during the claims process and ensures adherence to industry standards. Before initiating claims, assess damage from minor scratch repairs to extensive collision repair, contact your insurer for guidance, keep detailed records, and gather estimates from reputable shops for a smooth process.

Discover how to maximize your peace of mind by understanding and exercising your insurance-recommended repair rights. This guide breaks down the process step-by-step, from grasping the scope of your policy’s coverage to effectively navigating the claims process. Learn the importance of proper documentation and reporting when addressing essential repairs suggested by your insurer. Take control and ensure your property is restored to its best post-damage state.

- Understanding Your Insurance Policy's Repair Coverage

- Documenting and Reporting Recommended Repairs

- Navigating the Claims Process for Recommended Repairs

Understanding Your Insurance Policy's Repair Coverage

When it comes to protecting your vehicle, understanding your insurance policy’s repair coverage is a crucial step. Your insurance recommended repair rights are designed to ensure that your vehicle is restored to its pre-incident condition after an accident or damage, such as dent repair, hail damage repair, or even classic car restoration. By reviewing your policy, you can familiarize yourself with the extent of these benefits and what’s covered under your specific plan.

Each insurance provider has its own set of terms and conditions for recommended repairs. Some policies may offer comprehensive coverage, including all necessary parts and labor for various types of damage, while others might have limitations or require you to use a network of approved shops. Knowing these details allows you to make informed decisions when filing a claim, ensuring that your vehicle receives the appropriate dent repair, hail damage repair, or classic car restoration services as per your insurance provider’s guidelines.

Documenting and Reporting Recommended Repairs

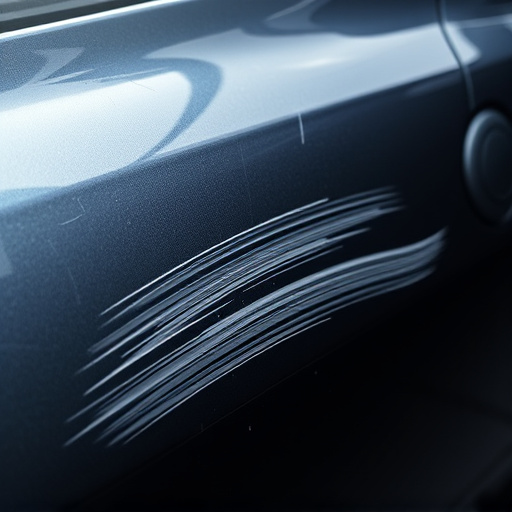

When it comes to insurance recommended repairs, proper documentation is key. After a car collision or other incident, ensure all damages and necessary repairs are thoroughly documented for your insurance claim. Take detailed photos of the affected areas, noting any cosmetic or structural issues. Keep records of all communications with your insurance provider, including dates, names, and discussion points related to the recommended repairs. These documents will serve as concrete evidence during the claims process, ensuring your rights are protected.

Additionally, make a comprehensive list of the repairs suggested by your insurance company or automotive repair services experts. This list should include parts replacements, mechanical fixes, body work, and any other necessary vehicle restoration procedures. Double-check that all recommended repairs align with industry standards and best practices for car collision repair. By meticulously documenting and reporting these details, you empower yourself to navigate the claims process more effectively, ensuring your insurance company adheres to their obligations in covering the necessary automotive repair services.

Navigating the Claims Process for Recommended Repairs

Navigating the claims process for recommended repairs can seem daunting, especially after a car collision or when dealing with persistent scratches on your vehicle’s finish. However, understanding your rights and the steps involved is key to ensuring fair compensation for necessary car damage repair. The first step is to review your insurance policy and understand the coverage limits for insurance recommended repair. Different policies have varying provisions, so it’s crucial to know what’s covered before initiating the claims process.

Once you’ve identified the extent of the damage, whether it’s a minor scratch repair or more extensive car collision repair, contact your insurance provider to file a claim. They will guide you through the next steps, which may include providing an estimate for the repair cost. It’s important to keep detailed records of all communications and documentation related to the incident and the recommended repairs to ensure a smooth process. This includes taking photos of the damage, gathering estimates from reputable repair shops, and preserving any reports or police statements filed after the incident.

Applying your insurance policy’s recommended repair rights can seem complex, but by understanding your coverage, documenting repairs thoroughly, and navigating the claims process diligently, you can ensure that necessary repairs are made effectively. Remember to review your policy for specific details on recommended repairs and reach out to your insurance provider for guidance if needed. By exercising your policyholder rights, you’re taking an essential step towards ensuring a secure and safe living environment after a loss or damage event.