Unexpected vehicle repairs can disrupt plans and strain budgets, but repair financing options provide much-needed relief by spreading costs over time, ensuring these events don't become long-term burdens and enabling individuals to promptly return to their daily routines with peace of mind. These flexible solutions cater to diverse needs, including auto body work, dent removal, and tire services, allowing drivers to make informed choices based on their financial capabilities and specific repair requirements.

Unexpected repairs can throw off even the best-planned budgets. Fortunately, repair financing options offer a safety net, enabling homeowners to manage these costs effectively. This article delves into the growing importance of repair financing as a strategic tool for managing unexpected maintenance expenses. We explore various options available, from traditional loans to innovative payment plans, empowering folks to navigate repairs with ease and peace of mind. Understanding these financing possibilities can make all the difference in handling sudden home repair bills.

- Understanding the Need for Repair Financing

- Exploring Various Repair Financing Options

- Navigating Repairs with Ease Through Financing

Understanding the Need for Repair Financing

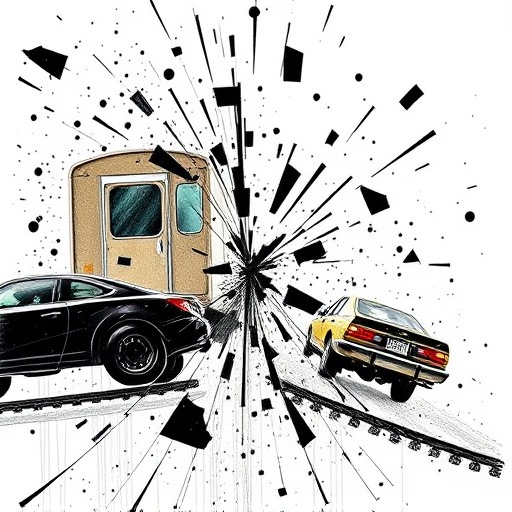

Unexpected repairs can throw a wrench into anyone’s plans and budget, especially when it comes to vehicle maintenance. This is where understanding and leveraging repair financing options becomes crucial. Many vehicle owners often find themselves in situations where immediate action is required, such as a fender repair or auto body repair, but the costs outweigh their immediate financial capabilities.

Having access to flexible repair financing options allows individuals to navigate these unforeseen circumstances without the added stress of financial strain. These options provide a safety net, enabling owners to take their vehicles to trusted collision centers and get them back on the road safely and efficiently. By spreading out the cost over time, repair financing ensures that unexpected repairs don’t become a financial burden, allowing folks to focus on getting back to their daily lives promptly.

Exploring Various Repair Financing Options

When faced with unexpected repair bills, many vehicle owners find themselves at a crossroads. This is where exploring various repair financing options becomes crucial. The good news is that a range of financial solutions are available to help cover these unforeseen costs. From traditional loans to innovative payment plans, these options ensure that you can access the necessary autobody repairs, car dent removal, or tire services without straining your budget.

Each financing option has its own set of advantages and considerations. For instance, some programs offer low-interest rates and flexible repayment terms, making them ideal for minor yet costly repairs. Others may have quicker approval processes, catering to those who need immediate assistance. By comparing different repair financing options, drivers can make informed decisions that align with their financial capabilities and repair needs.

Navigating Repairs with Ease Through Financing

Navigating unexpected repairs can be stressful, but with the help of repair financing options, car owners can breathe a sigh of relief. These financial tools provide a safety net, allowing individuals to cover costly automotive body work or essential car repair shop services without breaking the bank. By spreading out the cost over time, repair financing options ensure that emergency repairs don’t leave a significant dent in one’s finances.

Whether it’s minor dents and scratches or major restoration projects, access to repair financing can make these tasks more manageable. Many car repair shops now offer financing partnerships, providing customers with flexible payment plans tailored to their needs. This approach not only eases the financial burden but also encourages proactive maintenance, as vehicle owners are less likely to delay necessary repairs due to cost concerns.

Repair financing options play a pivotal role in easing the financial burden of unexpected home repairs. By understanding these diverse options and their benefits, homeowners can navigate unforeseen maintenance challenges with confidence and peace of mind. Exploring repair financing allows for timely interventions, ensuring that minor issues don’t escalate into costly disasters. Embracing these financing mechanisms is a strategic move towards proactive property management, enabling folks to stay ahead of potential problems and maintain the value of their homes.