PDR advantages (Paintless Dent Repair) offer a groundbreaking approach to auto body repairs, focusing on non-intrusive restoration of minor dents and hail damage. This method uses advanced tools and skilled technicians to restore original finishes without extensive paintwork, streamlining insurance claims, enhancing vehicle aesthetics, and catering to both insurers' swift processing needs and owners' desire for superior quality. By proactively assessing and documenting damage before repairs, PDR techniques save time, increase accuracy in cost estimation, facilitate quicker approvals through detailed reports, and ultimately lead to a more efficient, cost-effective claims management system.

“In the realm of insurance, understanding PDR (Pre-Determination Review) advantages can significantly streamline claims processes and improve approval rates. This article delves into the comprehensive overview of PDR benefits, exploring their profound impact on insurance approvals. We’ll dissect how PDR optimizes claims handling, ensuring a more efficient and effective system. By leveraging PDR advantages, insurance providers can enhance customer satisfaction while managing risks more effectively.”

- Understanding PDR Advantages: A Comprehensive Overview

- Insurance Approvals: The Impact of PDR Benefits

- Optimizing Claims Process: PDR's Role in Streamlining Approval

Understanding PDR Advantages: A Comprehensive Overview

Understanding PDR Advantages: A Comprehensive Overview

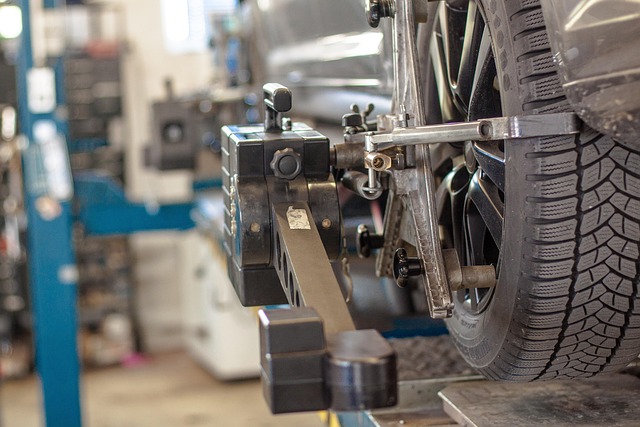

PDR advantages, or Paintless Dent Repair, is a revolutionary process in the realm of auto body repairs. This innovative technique offers a non-intrusive method for repairing hail damage and other minor dents on vehicles, ensuring minimal disruption to the car’s original finish. By leveraging specialized tools and skilled technicians, PDR advantages allow for precise restoration without the need for extensive paintwork or lengthy vehicle downtime.

This cutting-edge approach not only facilitates quicker insurance approvals due to its minimally invasive nature but also enhances the overall aesthetics of the vehicle. As compared to traditional auto body repairs, PDR advantages result in cleaner, more seamless restoration, making it a preferred choice for both insurance companies aiming for efficient claims processing and vehicle owners desiring top-notch vehicle restoration, including comprehensive hail damage repair and meticulous auto body repairs.

Insurance Approvals: The Impact of PDR Benefits

Insurance approvals play a pivotal role in ensuring smooth processes for both policyholders and insurance providers. When it comes to vehicle damages, particularly those involving complex repairs like car paint services or hail damage repair, having PDR (Paintless Damage Repair) advantages can significantly streamline the approval process. PDR benefits offer numerous advantages that directly impact these approvals.

One of the key impacts is the reduced cost and time associated with traditional collision repair shop processes. By utilizing specialized techniques to remove dents without sanding or painting, PDR offers a more efficient and economical solution. This not only saves money for insurance companies but also speeds up claim processing, leading to quicker approvals. Additionally, PDR’s non-invasive nature ensures minimal disruption to the vehicle’s original finish, making it an attractive option for policyholders looking for high-quality, yet cost-effective, car paint services.

Optimizing Claims Process: PDR's Role in Streamlining Approval

The role of PDR (Pre-Damage Repair) advantages is pivotal in optimizing the claims process and streamlining insurance approvals. By utilizing PDR techniques, auto body shops can proactively assess and document vehicle damage before any repairs commence. This pre-emptive approach not only saves time but also enhances accuracy in estimating repair costs. With detailed PDR reports, insurance providers can make informed decisions, leading to faster approval times.

PDR plays a crucial part in bridging the gap between the initial damage assessment and the final repair bill. It involves meticulous inspection, photography, and documentation of existing and potential issues on a vehicle’s body. This comprehensive process ensures that repairs are only carried out on necessary areas, reducing unnecessary costs for both customers and insurance companies. As a result, PDR advantages contribute to a more efficient and cost-effective claims management system in the auto body repair industry, benefiting both vehicle owners and insurers alike.

PDR advantages play a pivotal role in simplifying insurance approvals, enhancing efficiency, and ultimately improving customer satisfaction. By understanding and leveraging these benefits, insurance providers can streamline claims processes, reduce bureaucracy, and offer more seamless experiences to policyholders. Embracing PDR’s potential allows for a modern, data-driven approach to risk assessment and claim management, ensuring fair and timely approvals in today’s fast-paced world.