Insurance company negotiations are data-driven processes where insurers analyze historical trends and industry benchmarks to set fair repair costs. They use risk assessment models to predict costs and negotiate for mutually beneficial agreements while managing risks. Faster outcomes are achieved through clear policyholder communication, detailed documentation, and choosing companies with streamlined processes like pre-approved bodywork shops. Effective insurance company negotiations require understanding these strategies, leveraging key insights, and mastering communication and policy language for favorable coverage terms and cost savings.

Insurance company negotiations can often be a lengthy and frustrating process, but understanding the driving factors behind faster outcomes can empower policyholders. This article delves into the intricate world of insurance negotiations, exploring key strategies employed by insurers and the tactics that can expedite claims resolution. By uncovering the influences behind quicker settlements, individuals can navigate these conversations more effectively, ultimately saving time and stress. Learn how to trigger positive changes in insurance company negotiations and reclaim control over your claims process.

- Understanding Insurance Company Negotiation Strategies

- Key Factors Influencing Faster Settlement Times

- Effective Tactics to Expedite Claims Resolution

Understanding Insurance Company Negotiation Strategies

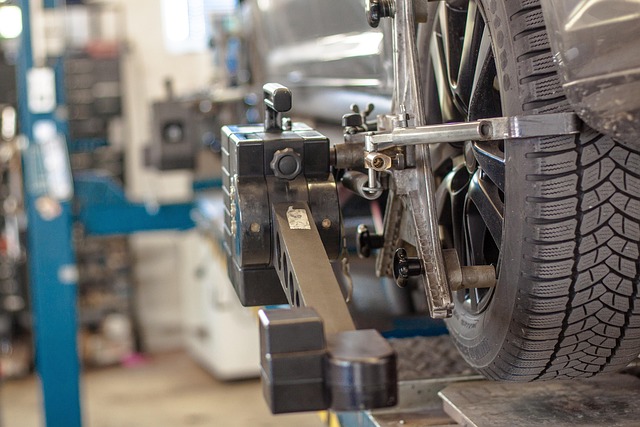

Insurance company negotiations can be complex, but understanding their strategies is key to achieving faster outcomes. Companies employ various tactics to assess claims, set settlement amounts, and negotiate with policyholders. One common approach is to analyze historical data and industry trends to determine fair market values for repairs or replacements, such as auto glass repair, auto painting, or car bodywork services. By leveraging these insights, insurers can offer more accurate and reasonable settlements.

Additionally, insurance companies often utilize risk assessment models to predict potential liabilities and costs associated with a claim. They consider factors like the severity of damage, local labor rates for repairs (like those for auto glass repair or car bodywork), and historical settlement patterns within similar cases. This data-driven approach allows insurers to negotiate more effectively, aiming for mutually beneficial agreements while managing their financial exposure efficiently.

Key Factors Influencing Faster Settlement Times

Several key factors play a pivotal role in triggering faster insurance company negotiations outcomes. Firstly, clear and detailed communication is paramount. Policyholders who provide concise, well-documented information about the incident and subsequent damage, such as photographs of car scratches or car bodywork repairs needed, facilitate efficient assessments and negotiations. This proactive approach ensures that both parties have a shared understanding from the outset, streamlining the process.

Secondly, choosing an insurance company renowned for its swift settlement times can significantly impact the outcome. Reputable insurers prioritize customer satisfaction and often employ streamlined processes for vehicle body repair claims, including pre-approved networks of trusted car bodywork shops. This not only expedites repairs but also reduces potential disputes over the quality or cost of the work, leading to quicker negotiations and resolutions.

Effective Tactics to Expedite Claims Resolution

Insurance company negotiations can be streamlined through a combination of understanding strategic approaches, recognizing influential factors, and employing effective tactics. By leveraging data-driven insights, maintaining open communication, and adopting technology for efficient processes, policyholders can expedite claims resolution. This not only benefits individuals seeking fair compensation but also promotes a more responsive and adaptive insurance industry as a whole, ultimately enhancing customer satisfaction.