Optimizing body shop turnaround time is crucial for automotive repairs, impacting customer satisfaction and business success. Efficient times result from tracking metrics like repair duration and first-time fix rates, enabled by insurance backing that covers costs and allows investment in technology. Digital solutions and proactive communication with insurers further streamline processes, reducing wait times and enhancing experiences for customers and body shop ecosystems.

In today’s competitive automotive repair landscape, minimizing body shop turnaround times is paramount for success. Effective management of these processes directly impacts customer satisfaction and business profitability. This article explores how insurance plays a pivotal role in optimizing body shop turnaround times. We delve into key metrics, the influence of insurance on streamlining operations, and strategic approaches to reduce wait times through efficient claims handling. Understanding these dynamics is essential for shops aiming to deliver timely, quality repairs.

- Understanding Body Shop Turnaround Time Metrics

- The Role of Insurance in Streamlining Processes

- Strategies to Reduce Wait Times with Efficient Claims Handling

Understanding Body Shop Turnaround Time Metrics

In the realm of automotive repairs, understanding body shop turnaround time is paramount for both businesses and clients alike. This metric refers to the period between a vehicle’s initial drop-off at the workshop and its final collection, encompassing various stages such as assessment, repair, and quality control. Efficient turnaround times are not just about customer satisfaction; they also indicate a well-organized and skilled operation. For instance, a body shop specializing in Mercedes Benz repair or car scratch repair should aim to balance throughput with meticulous craftsmanship to ensure vehicles are restored promptly without compromising quality.

When evaluating a body shop’s performance, several key metrics come into play. These include average repair duration, first-time fix rates, and the efficiency of communication with insurance providers. For fleet repair services, where timely turnaround is crucial for businesses operating multiple vehicles, these metrics can make or break a partnership. By tracking and analyzing body shop turnaround time, stakeholders gain valuable insights to optimize processes, enhance productivity, and ultimately, deliver superior service experiences.

The Role of Insurance in Streamlining Processes

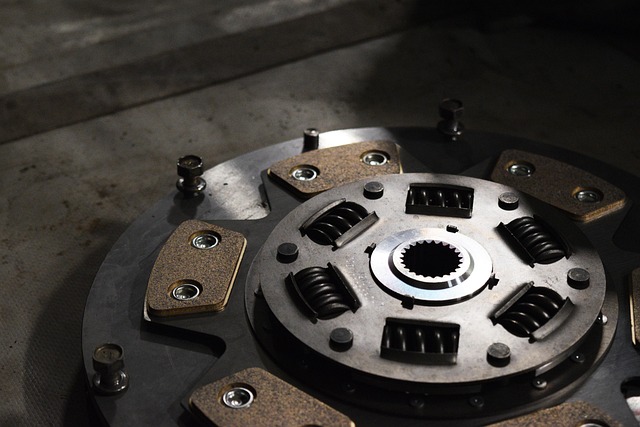

Insurance plays a pivotal role in streamlining body shop turnaround times by providing financial coverage and support during the repair process. When an accident occurs, insurance companies offer a safety net that helps body shops cover the costs of materials, labor, and equipment needed to restore damaged vehicles. This financial stability allows shops to invest in efficient systems and technology, ultimately speeding up service times.

Additionally, insurance policies often include guidelines and processes for damage assessment and claim handling, which promote standardized procedures. These structured protocols facilitate smooth communication between insurers, body shops, and policyholders, minimizing delays caused by paperwork or clarification requests. By fostering a collaborative environment, insurance can contribute to a more streamlined auto painting and automotive collision repair process, benefiting both businesses and their customers in terms of reduced body shop turnaround time.

Strategies to Reduce Wait Times with Efficient Claims Handling

In today’s competitive market, where customer satisfaction is paramount, reducing wait times at a vehicle body shop can significantly impact its reputation and success. Efficient claims handling is a strategic tool to streamline the process, ensuring faster turnaround times for repairs. By implementing digital solutions, such as automated forms and online claim submissions, shops can capture data accurately from the onset, minimizing errors that often lead to delays.

Additionally, proactive communication with insurance providers plays a pivotal role. Establishing clear lines of communication and utilizing specialized software for seamless information exchange can speed up the assessment and approval process. These strategies not only enhance customer experience but also foster a positive relationship between the body shop, customers, and insurers, ultimately benefiting the entire collision center ecosystem, including Mercedes-Benz collision repair facilities.

Insurance plays a pivotal role in optimizing body shop turnaround times by streamlining claims handling processes. By understanding key metrics, adopting efficient strategies, and collaborating effectively with insurance providers, body shops can significantly reduce wait times. This not only enhances customer satisfaction but also contributes to a more competitive and responsive automotive repair industry. Optimizing body shop turnaround time is crucial for keeping up with demand, ensuring efficient operations, and ultimately improving overall service quality.