Understanding accident repair estimates is crucial for fair and informed decisions when dealing with car accident damages. By evaluating detailed cost breakdowns, comparing from various providers, and knowing consumer rights, individuals can ensure quality repairs while adhering to insurance coverage limits. This process empowers consumers to navigate unexpected events effectively.

In the intricate web of financial protection, understanding insurance and its role in accident repair estimates is paramount. This comprehensive guide deciphers the complexities hidden within these estimates, shedding light on what they cover. We navigate insurance policies, exploring accidental damage coverage options available to policyholders. Furthermore, we equip readers with knowledge on disputing repair bills, empowering them to make informed decisions during unforeseen events.

- Deciphering Accident Repair Estimates: What They Cover

- Navigating Insurance Policies: Accidental Damage Coverage

- Understanding Your Rights: Disputing Repair Bills

Deciphering Accident Repair Estimates: What They Cover

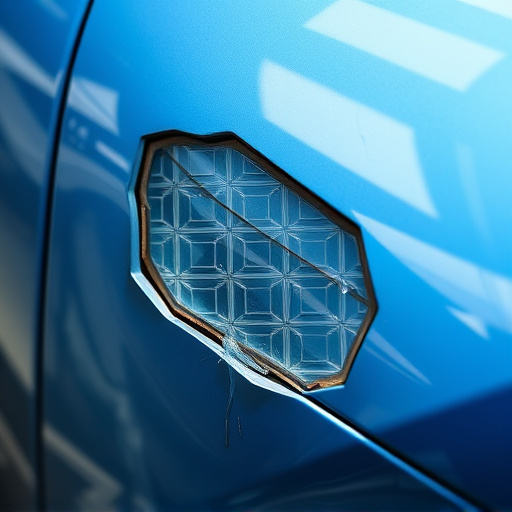

When you’re faced with a car accident, understanding your insurance policy and what it covers can be a confusing process. A crucial component in this is deciphering accident repair estimates. These estimates detail the costs associated with restoring your vehicle to its pre-accident condition. They encompass a wide range of services, from structural repairs like replacing bent frames and damaged panels to more specialized tasks such as paintless dent repair for minor scratches and dents.

Additionally, these estimates may include expenses related to paint jobs, mechanical work, and even rental cars while your vehicle is in the shop. Familiarizing yourself with these estimates allows you to make informed decisions about your repair process, ensuring you receive quality vehicle repair services while adhering to your insurance coverage limits.

Navigating Insurance Policies: Accidental Damage Coverage

Navigating insurance policies for accidental damage coverage is a crucial step in understanding your protection when unexpected incidents occur. Insurance plans often include specific clauses dedicated to covering repairs resulting from accidents, offering peace of mind and financial assistance during challenging times. These policies can vary widely, so it’s essential to scrutinize the fine print.

Accident repair estimates play a significant role in this process as they provide detailed breakdowns of potential costs for various types of damage, including auto glass replacement, automotive collision repair, and auto body services. By comparing these estimates from different providers, policyholders can make informed decisions about their coverage options, ensuring they receive adequate compensation for accidental damages to their vehicles.

Understanding Your Rights: Disputing Repair Bills

When dealing with accident repair estimates, it’s crucial to understand your rights as a consumer. Disputing repair bills is not uncommon and can be a complex process, but knowing your entitlements is key to ensuring fairness. If you feel the estimated cost for auto maintenance or dent repair is inaccurate or excessive, don’t hesitate to question it. You have the right to receive transparent quotes detailing the work required, parts needed, and labor costs involved in automotive restoration processes.

Engaging with your insurance provider and the repair shop directly can help clarify any discrepancies. Examine the estimate closely, verifying each itemized cost. Remember that you’re not obligated to accept a quote immediately; taking time to research comparable prices and seeking second opinions can save you significant amounts on accident-related repairs, ensuring you receive fair compensation for necessary auto maintenance or intricate automotive restoration work.

Accident repair estimates can be complex, but understanding your insurance policy and your rights is key to navigating this process smoothly. By deciphering what your accident repair estimates cover and learning how to dispute bills if necessary, you can ensure that you’re not left with unexpected costs after a crash. Remember, knowledge is power when it comes to managing auto repairs following an accident.