An insurance estimate review is vital for ensuring fairness in claims, especially for complex repairs like car dent repair or auto detailing. Experts meticulously examine initial assessments, verifying costs against industry standards and specific needs. This process protects claimants' interests, expedites settlements, prevents disputes with body shops, and ensures accurate damage assessment and cost estimation. By proactively challenging inaccurate estimates, individuals can negotiate fairer settlements and choose tailored insurance plans based on understanding key components like deductibles, premiums, and exclusions.

An insurance estimate review is an essential process that plays a pivotal role in facilitating efficient and fair claim settlements. This rigorous evaluation involves scrutinizing the estimates provided by insured parties, ensuring accuracy and supporting decision-making. By delving into this process, we uncover its multifaceted benefits for claimants and insurers alike. Discover how a thorough review streamlines settlement procedures, enhances transparency, and ultimately contributes to a more satisfactory outcome for all involved.

- Understanding Insurance Estimate Review: The Process and Its Purpose

- Benefits of a Thorough Insurance Estimate Review for Claimants

- How Insurance Companies Utilize Estimate Reviews to Streamline Settlements

Understanding Insurance Estimate Review: The Process and Its Purpose

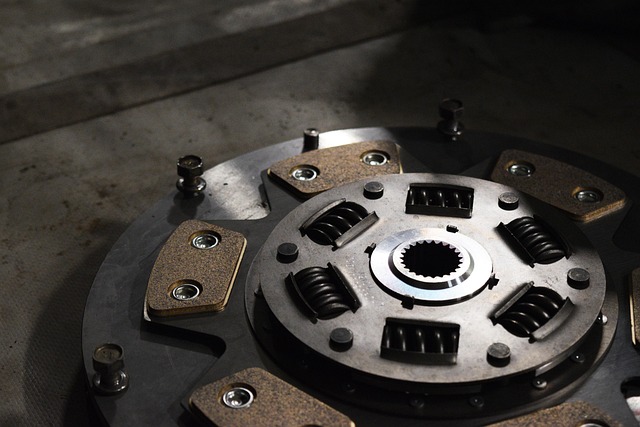

Insurance estimate review is a critical process where experts scrutinize an insurance company’s initial claim assessment. It involves a detailed analysis of the provided estimate, ensuring it aligns with industry standards and the specific needs of the claimant. The primary purpose is to verify the accuracy and comprehensiveness of the estimated repair costs for various types of damage, such as car dent repair or auto detailing.

By conducting an insurance estimate review, claimants can protect their interests and ensure a fair settlement. It helps identify any discrepancies, overcharges, or omissions in the original estimate. This process is particularly important when dealing with vehicle body shops, where complex repairs may involve multiple components and services. A thorough review can expedite the claim settlement process and prevent potential disputes.

Benefits of a Thorough Insurance Estimate Review for Claimants

A thorough insurance estimate review offers several significant benefits to claimants navigating the often complex process of car accident claims. By closely examining the appraisal reports provided by auto body shops or repair services, claimants can ensure that their insurance companies are accurately assessing the extent of damage and associated costs for auto body work. This step is crucial in avoiding underestimates or inaccurate assessments, which can lead to delayed claim settlements or inadequate compensation.

Additionally, a meticulous review enables claimants to identify potential discrepancies or errors in the estimate. Whether it’s a miscalculation of parts needed or labor rates charged by the auto body shop, catching these mistakes early in the process can save time and money. This proactive approach empowers claimants to challenge inaccurate estimates and negotiate fairer settlements with insurance companies, ultimately ensuring they receive the full extent of compensation for the car repair services required after an accident.

How Insurance Companies Utilize Estimate Reviews to Streamline Settlements

An insurance estimate review is a pivotal process that facilitates efficient claim settlements. By meticulously scrutinizing repair estimates, claimants can ensure their rights are protected and they receive fair compensation. Similarly, insurance companies benefit from this review process, enabling them to streamline settlement procedures, reduce fraud, and enhance overall customer satisfaction. Embracing insurance estimate review as a standard practice is thus beneficial for all parties involved, fostering transparency and integrity in the claims process.