Before upgrading collision repair insurance, assess individual needs based on vehicle age, condition, driving history, and local repair costs. Compare current coverage with newer plans, focusing on services offered and specific repair requirements. Ensure your policy aligns with these needs to protect your vehicle and budget from accidents or restoration needs. Reassess coverage periodically after changes in ownership or driving habits for optimal benefits and peace of mind.

“Collision repair insurance is an essential component of any vehicle owner’s safety net. However, as your needs and the automotive landscape evolve, it’s crucial to reassess your coverage. This article guides you through the process of upgrading your collision repair policy, focusing on three key areas: understanding your unique collision repair needs, identifying gaps in current coverage, and timing upgrades for maximum benefits. By the end, you’ll be equipped to make informed decisions regarding your vehicle’s protection.”

- Understanding Your Collision Repair Needs

- Assessing Policy Coverage Gaps

- Timing Upgrades for Optimal Benefits

Understanding Your Collision Repair Needs

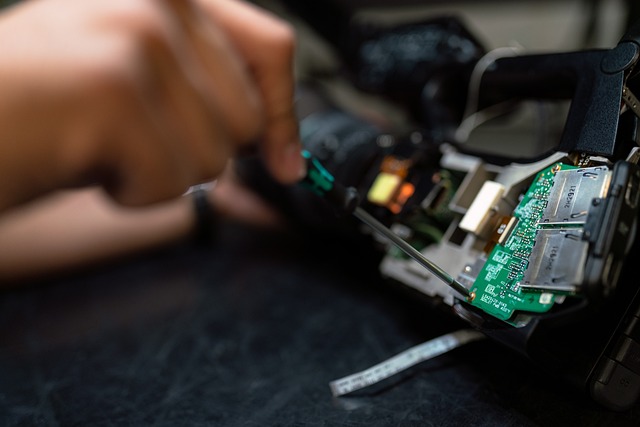

Before deciding to upgrade your collision repair insurance policy, it’s crucial to understand your specific needs when it comes to vehicle repair. Collision repair insurance isn’t one-size-fits-all; what works for someone else might not be suitable for you. Consider factors like the age and condition of your vehicle(s), your personal driving history, and the average cost of repairs in your area. If you drive an older car that’s prone to more frequent dent repairs or other common issues, a more comprehensive policy might be beneficial.

Knowing the types of services covered by different collision repair insurance plans is essential. Some policies may only cover major structural damage, while others could include detailed body work and even cosmetic enhancements. Look into what your current plan offers and compare it to newer options that might provide better coverage for your vehicle repair needs, including services like dent repair or paintless dent repair at a trusted collision center.

Assessing Policy Coverage Gaps

When considering an upgrade to your collision repair insurance policy, a thorough assessment of existing coverage gaps is essential. Start by reviewing the details of your current plan, focusing on what’s covered and what isn’t in the event of a collision, such as a fender bender or more severe automotive restoration needs. Collision repair insurance typically covers repairs to vehicle damage caused by accidents, but not all policies are created equal. Some may exclude certain types of damages or have deductibles that could significantly impact your financial burden following an incident.

For instance, while most policies will cover the cost of auto glass replacement, they might have restrictions on the type of glass used for repairs. Understanding these nuances is crucial to ensuring adequate protection for your vehicle and peace of mind. By identifying gaps in your current coverage, you can make informed decisions about upgrading your policy to better suit your needs and budget, especially if you frequently experience minor accidents or value comprehensive automotive restoration services.

Timing Upgrades for Optimal Benefits

The timing of upgrading your collision repair insurance policy is a strategic decision that can significantly impact your overall benefits and peace of mind. It’s advisable to reassess your coverage periodically, ideally after significant changes in your vehicle ownership or driving habits. For instance, if you recently acquired a luxury vehicle like a Mercedes Benz, ensuring specialized coverage for its intricate auto body repairs becomes essential. Similarly, frequent involvement in minor fender benders might indicate the need for an upgraded policy to cover these recurring expenses without breaking the bank.

Regular upgrades allow you to stay ahead of evolving repair technologies and techniques, especially in the ever-advancing automotive industry. This is particularly relevant when considering complex repairs, as new methods and materials can dramatically affect costs and vehicle restoration quality. By staying current with your collision repair insurance, you can access optimal benefits tailored to modern vehicle needs, ensuring a seamless and effective restoration process for any make or model, whether it’s a standard sedan or a high-end sports car.

Collision repair insurance is a vital component of any vehicle owner’s safety net. By regularly assessing your policy’s coverage gaps and timing upgrades appropriately, you can ensure that your vehicle receives the best care in the event of an accident. Stay informed and proactive to protect both your peace of mind and investment.